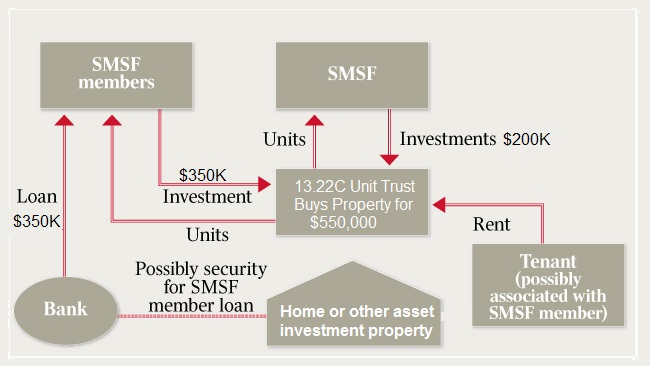

Self-Managed Super Funds (SMSFs) have become increasingly popular among Australians seeking greater control and flexibility over their retirement savings. One of the key investment options within SMSFs is property ownership. In this article, we’ll delve into the intricacies of property ownership in SMSFs, exploring its benefits, legal considerations, acquisition process, risks, and mitigation strategies.

Introduction to SMSF

SMSF is a type of superannuation fund that gives members the autonomy to manage their own retirement savings. Unlike traditional super funds, where investment decisions are made by fund managers, penalty for living in smsf property trustees have the authority to choose where their funds are invested, including in property.

Understanding Property Ownership in SMSF

Benefits of Property Ownership in SMSF

Investing in property through SMSF offers several advantages. Firstly, it provides diversification within the fund’s investment portfolio, reducing overall risk. Secondly, rental income generated from the property can contribute to the fund’s earnings, boosting retirement savings. Additionally, capital gains derived from property appreciation are taxed at a concessional rate within the SMSF environment.

Considerations before Investing in Property through SMSF

However, property ownership in SMSF requires careful consideration. Trustees must ensure compliance with legal requirements and regulations set by the Australian Taxation Office (ATO) to avoid penalties and potential disqualification of the fund.

Legal Requirements and Regulations

Compliance with the Sole Purpose Test

The ATO mandates that all SMSF investments must align with the sole purpose of providing retirement benefits to members. Therefore, any property purchased through an SMSF must be solely for investment purposes and not for personal use or benefit until retirement.

Borrowing Restrictions and Regulations

SMSFs are permitted to borrow funds to acquire property under limited recourse borrowing arrangements (LRBAs). However, strict regulations govern such borrowings, including the prohibition of borrowing for property improvements or renovations.

Steps to Acquire Property in SMSF

Setting up an SMSF

Before investing in property, individuals must establish an SMSF, appoint trustees, and develop an investment strategy tailored to their financial goals and risk tolerance.

Investment Strategy Development

The investment strategy should outline the fund’s objectives, asset allocation, and risk management approach, including considerations specific to property investment.

Property Purchase Process

Once the SMSF is established, trustees can commence the property acquisition process, which involves conducting thorough due diligence, obtaining finance (if applicable), and completing the purchase transaction.

Risks and Challenges Associated with Property Ownership in SMSF

While property investment can yield lucrative returns, it also entails certain risks and challenges within the SMSF context.

Liquidity Risks

Property is considered a relatively illiquid asset, meaning it may be challenging to sell quickly if the need for cash arises within the fund.

Market Fluctuations

The property market is susceptible to fluctuations, which can impact the value of the fund’s investment and overall returns.

Limited Diversification

Investing a significant portion of the SMSF in property may limit diversification opportunities, exposing the fund to concentration risk.

Strategies to Mitigate Risks

Diversification within SMSF

To mitigate concentration risk, trustees should diversify their SMSF investment portfolio across various asset classes, including equities, bonds, and cash.

Regular Review of Investment Strategy

Periodic review of the SMSF’s investment strategy is crucial to ensure alignment with changing market conditions and members’ retirement objectives.

Property ownership in SMSF presents an attractive opportunity for individuals seeking to enhance their retirement savings through real estate investment. However, it is essential to navigate the legal requirements, understand the associated risks, and implement prudent risk mitigation strategies to safeguard the fund’s long-term financial security.

FAQs

- Can I live in a property owned by my SMSF?

No, the property owned by an SMSF must be solely for investment purposes until retirement.

- Are there restrictions on borrowing to purchase property through SMSF?

Yes, SMSFs can only borrow funds under limited recourse borrowing arrangements (LRBAs), and strict regulations govern such borrowings.

- How often should I review my SMSF’s investment strategy?

It is recommended to review the SMSF’s investment strategy regularly, at least annually, to ensure it remains aligned with your financial goals and market conditions.

- What happens if my SMSF fails to comply with legal requirements?

Non-compliance with legal requirements may result in penalties imposed by the ATO and potentially disqualification of the SMSF.

- Can I sell a property owned by my SMSF if needed?

While possible, selling a property owned by an SMSF may take time due to the illiquid nature of real estate assets, so careful consideration and planning are necessary.